72% less fluctuation in the qualification of insurance agents at €650,000 lower cost

Nürnberger Versicherung has ushered in a new era of onboarding with Retorio. It uses Retorio's AI sales coaching to get career changers into the job faster and reduce agent turnover by 72% in the first year.

Industry: Insurance

Use case: Sales force training

Market: Germany

- Onboarding the sales force: Nürnberger trains around 150 new sales agents every year - many of whom are career changers with little or no experience in insurance sales.

- Getting new agents into the job fast: New agents need to ramp-up within a few months, so that they can quickly close new clients and finance themselves.

- High costs due to fluctuation in the onboarding phase: Despite high investments in new agent qualification, Nürnberger recorded an 18% drop-out rate during onboarding phase – leading to high direct and opportunity costs.

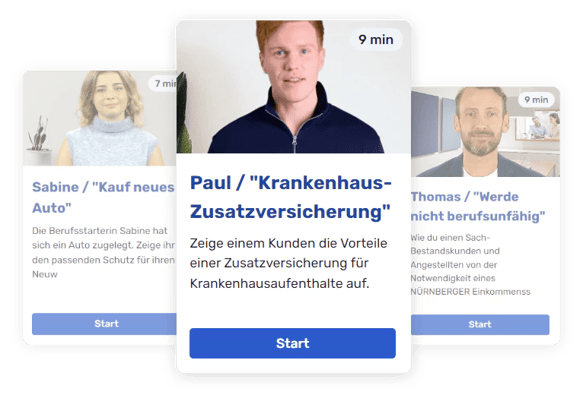

- Virtual Customer: The team used Retorio's AI Generator to create realistic simulations based on Nürnberger's key customer personas. These formed the basis of a digital onboarding journey, including sales conversations for core products like car and life insurance.

- Customized simulations: All simulations include product-specific content and follow Nürnberger's proven sales methods, enabling new agents to practice both product knowledge and communication skills in a realistic, risk-free setting.

- Roll-out in 2023: After a successful pilot, AI-powered customer simulations became a core part of new agent training in 2023. Since 2024, existing sales agents have also benefited through targeted, practical training.

- Faster ramp-up through realistic and frequent practice:With Retorio, new agents complete up to seven times more role plays and receive 52 AI evaluations before their first customer interaction—accelerating readiness and confidence.

- 72% lower turnover in year one: Agent turnover drops from 18% to 5% thanks to AI coaching. Employees feel better prepared and supported.

- €650K+ in cost savings: Automated onboarding cuts classroom training costs by €650,000, not including savings from lower turnover. The ROI exceeds 10x.

7x

more practice before the first customer meeting

-72%

from 18% to 5% within the first year after introduction

650.000€

through automation of traditional coaching programs

"Using Retorio's AI has allowed us to complement traditional face-to-face and e-learning solutions and take an innovative approach. Traditional, face-to-face training can sometimes be passive, which in turn leads to participants not engaging. With "Kl am Steuer", we have developed a transformative approach that keeps participants motivated and helps them take control of their customer-centric development."

"As Retorio's training is web-based, it integrated seamlessly into our processes. And the simple navigation enabled our employees to navigate the platform quickly and confidently. It was remarkable how the platform also made it possible to accompany the participants throughout the entire process, and the interactive and practical training sessions in a protected space created added value for everyday sales - proof of the effectiveness of Retorio's innovative approach to AI-based training."

"Through the AI training, I have started to pay more attention to how I come across to customers in conversations."

Customized AI coaching: Nürnberger Versicherung's model for success

Individual video simulations in onboarding

Nürnberger Versicherung creates and maintains its onboarding video simulations independently - directly by the employees in the training department. Retorio's AI-supported session generator is used for this, in which all of Nürnberger's relevant customer personas are stored centrally. This creates realistic training situations that are optimally tailored to everyday sales.

IDD-compliant training with Retorio

Nürnberger also uses Retorio for IDD-relevant training programs and thus meets the regulatory requirements of the insurance industry. Participants' training times are automatically recorded by Retorio and transmitted to the responsible admin team - for maximum transparency and traceability.

Focus on products & sales expertise

The training content covers key insurance products - including car insurance, income protection, supplementary health insurance, pensions and homeowners insurance. At the same time, essential sales skills are taught: from professional objection handling to a holistic sales approach.

ROI calculator

Transfer the Nürnberger Versicherung business case to your company

About Nürnberger Versicherung

NÜRNBERGER Versicherung is a traditional and renowned German insurance company based in Nuremberg. Its products in the areas of life insurance, private health insurance, property insurance, accident insurance and car insurance as well as financial services are consistently geared towards its customers and their needs. The listed parent company of the Group is NÜRNBERGER Beteiligungs-AG.