The insurance industry is under siege.

Did you know that 70% of customers now expect personalized digital interactions—and only 25% of insurers feel prepared to deliver them? 1 At the same time, Insurtech startups are growing 5x faster than traditional carriers by weaponizing AI, automation, and data analytics.2

So, ask yourself:

- Are your sales teams struggling to keep pace with rising digital expectations?

- Is your training scalable, consistent, and cost-effective across distributed agents?

- Can you prove the ROI of your current sales coaching strategy?

If any of these questions hit home, you're not alone. A staggering 87% of sales training is forgotten within a month without reinforcement3—yet most insurers still rely on outdated, one-size-fits-all methods. Meanwhile, digital leaders in insurance outperform laggards by up to 4x in revenue growth and profit.

In this high-stakes environment, AI sales coaching isn’t just a new tool—it’s a strategic necessity.

Advanced AI-driven platforms like Retorio empower insurers to deliver personalized, real-time coaching at scale, reduce training costs, and optimize rep performance based on behavioral data—not just intuition.

The time to act is now.

The longer your team relies on conventional training methods, the wider the performance gap becomes. This post will explore how AI coaching addresses today's most pressing sales challenges—and why adopting it today could be your competitive edge tomorrow.

Industry Pressures

In today’s rapidly evolving insurance landscape, Learning & Development (L&D) leaders find themselves at the intersection of unprecedented change and opportunity. As digital transformation redefines operational models and customer engagement, the need to upskill teams—especially in customer-facing and decision-critical roles—has never been more urgent. L&D managers must equip agents and employees not only with technical competencies but also with adaptive soft skills, such as communication, empathy, and compliance acumen.

- Digital transformation imperative: The entire insurance sector is undergoing a profound digital transformation. However, many established insurers are encumbered by legacy systems that impede agility, create data silos preventing unified customer views, and hinder the delivery of the seamless digital experiences customers now demand. Embarking on this transformation journey is essential for survival and growth, but it represents a costly and complex undertaking, requiring significant investment and careful change management.

- Evolving customer expectations: Influenced by experiences in other sectors, insurance customers now expect hyper-personalization, effortless interactions across multiple channels (omnichannel), and greater transparency. Failing to meet these heightened expectations directly impacts customer loyalty, retention, and ultimately, profitability. Research indicates insurers delivering consistently exceptional customer experiences achieve notably higher profitability.

- Intensifying competition: The competitive landscape has shifted dramatically. Traditional insurers are not only competing against each other but also against nimble, digital-native Insurtech companies that leverage AI and advanced analytics to offer innovative products and streamlined experiences. This pressure is palpable, with a significant majority of insurance executives acknowledging the urgent need to adopt generative AI technologies rapidly to remain competitive. Effective differentiation through superior service and agent capability is paramount.

- Regulatory complexity & trust: The insurance industry operates within a web of complex regulations, including evolving rules around AI usage (like the E.U. AI Act), data privacy mandates (such as GDPR), and fair practices. Building and maintaining customer trust is fundamental, particularly as AI plays a larger role in processes like underwriting and pricing.Concerns about data privacy and the potential for bias in AI systems are significant hurdles that demand transparency and robust compliance frameworks. AI systems involved in high-risk decisions, like insurance underwriting, face increasing regulatory scrutiny demanding explainability.

To navigate these multifaceted pressures—from digital disruption and shifting customer expectations to regulatory demands and competitive threats—insurance firms must invest in their most powerful asset: their people.

By integrating AI-enabled training solutions like Retorio, L&D leaders can future-proof their workforce, accelerate the adoption of digital tools, and embed a culture of continuous learning and trust. As insurers work to deliver hyper-personalized, omnichannel experiences while maintaining ethical and regulatory standards, the ability to scale intelligent training programs will be a defining factor in long-term success. Retorio empowers insurers not just to survive this transformation—but to lead it.

Talent & Cost Pressures

In today’s rapidly evolving insurance landscape, Learning & Development (L&D) leaders and managers face an increasingly complex challenge: how to equip their workforce with the right skills while navigating significant talent and budget constraints. From digital transformation demands to the accelerating pace of customer expectations, organizations are under pressure to deliver agile, scalable training programs that drive performance without compromising cost-efficiency. At the heart of this challenge lies the need for intelligent, data-driven solutions—like those offered by Retorio—which fuse behavioral science with AI to transform traditional training into adaptive, personalized learning journeys that enhance both retention and readiness.

- High agent turnover: The insurance sector consistently battles high employee fluctuation, a problem that has reportedly worsened recently with agent turnover rates nearly doubling. This constant churn is incredibly costly, wasting valuable training resources and time, as newly trained agents often leave before delivering a positive return on the investment made in them.The cost to replace a single skilled worker can be substantial, running into tens of thousands of dollars.

- Skills gap: A pronounced digital skills gap persists within the industry. Many organizations express concern about finding and retaining talent equipped to navigate and leverage modern technologies effectively. Beyond technical skills, broader readiness challenges exist, highlighted by data showing a large percentage of new managers feel unprepared for their roles , suggesting systemic issues in skill development and onboarding.

- Budget constraints: Despite the clear need for investment in training and digital tools, training budgets often face constraints and can be among the first areas affected during cost-cutting measures. This creates a direct conflict with the substantial investments required for digital transformation initiatives and talent development programs. Sales Enablement leaders frequently cite limited budgets and personnel as significant pain points.

These factors create a challenging dynamic. Legacy systems, for instance, often require significant ongoing IT expenditure for maintenance and integration efforts. These costs directly compete for funds that could otherwise be allocated to modernizing business processes, including the adoption of advanced sales training platforms.

Consequently, Sales Enablement and L&D departments face an uphill battle securing the necessary budget for innovation. Paradoxically, the very inefficiencies imposed by these older systems—such as fragmented customer data hindering personalized interactions —make effective, targeted sales coaching more crucial for success.

Yet, the budget limitations they contribute to make scaling traditional, resource-intensive coaching methods virtually impossible. This deadlock underscores the need for solutions that offer both effectiveness and cost-efficiency at scale, positioning AI-driven coaching as a viable path forward.

Beyond Traditional Methods: The Limits of Current Sales Training

While the need for effective sales coaching intensifies, traditional approaches face inherent limitations, particularly within the context of large insurance enterprises.

- Scalability & cost: One-on-one coaching, while highly impactful when done well, is notoriously difficult and expensive to scale across geographically dispersed salesforces numbering in the thousands . The personnel and logistical costs associated with providing consistent, personalized coaching to every agent using conventional methods are often prohibitive.

- Consistency & quality: Maintaining uniformity in messaging, ensuring strict adherence to compliance protocols, and guaranteeing consistent coaching quality across numerous managers, teams, and locations presents a significant operational challenge. Variations in manager skill, focus, and available time can lead to uneven agent development.

- Engagement & retention: Traditional training formats, including standard e-learning modules, frequently suffer from low learner engagement. Data suggests activation rates for conventional e-learning can be below 50%, with completion rates sometimes as low as 10-30% . Compounding this is the well-documented "forgetting curve," where knowledge acquired during training sessions rapidly fades without ongoing reinforcement and practical application.

- Time & resource constraints: Front-line sales managers, who are ideally positioned to provide coaching, often have their time consumed by administrative tasks and internal meetings, leaving limited bandwidth for dedicated coaching sessions. Research indicates managers may spend as little as 21% of their time on coaching activities. Furthermore, organizational pressure to deliver immediate, short-term sales results can overshadow the importance of investing time in deeper, long-term skill development. Limited trainer capacity also acts as a significant bottleneck in rolling out initiatives .

- Measurement & impact: Quantifying the direct impact of traditional training programs on tangible business outcomes—such as sales KPIs, revenue growth, or ROI—is often difficult and imprecise. This lack of clear measurement makes it challenging to justify training investments and to identify areas for program improvement based on data.

- Personalization: Generic, one-size-fits-all training programs fail to cater to the unique strengths, weaknesses, and learning needs of individual agents. This lack of personalization can lead to demotivation and reduced learning effectiveness. In an era where customers expect hyper-personalized interactions , developing agents requires a similarly tailored approach.

A critical paradox emerges: the demand for personalized, effective coaching is rising sharply, driven by factors like increasing product complexity, the need for sophisticated customer engagement, and the goal of improving agent retention. However, the practical capacity to deliver this coaching through traditional means is simultaneously shrinking due to escalating time pressures on managers and persistent cost constraints.

This widening gap between need and capacity creates a significant vulnerability for insurance enterprises. AI coaching platforms are uniquely positioned to bridge this gap. They do not necessarily aim to replace human managers but rather to augment their capabilities by providing a scalable, consistent platform for practice, feedback, and skill reinforcement.

This frees managers to focus on higher-value strategic coaching, complex deal support, and relationship building, while ensuring all agents have access to personalized development opportunities.

The Strategic Advantage: Introducing AI Sales Coaching for Insurance

AI Sales Coaching leverages the power of artificial Intelligence to create dynamic, interactive learning experiences for sales professionals. It involves using AI to simulate realistic customer interactions, analyze agent performance across both verbal and non-verbal dimensions, deliver immediate, personalized feedback, and track skill development over time at scale.

For the insurance industry, the strategic advantages are particularly compelling:

- Complexity handling: Insurance products can be intricate, and customer needs diverse. AI coaching allows agents to repeatedly practice navigating complex product discussions, addressing specific customer personas (e.g., small business owners, high-net-worth individuals, claimants), and managing difficult conversations in a risk-free environment .

- Compliance assurance: In a highly regulated industry, ensuring compliant communication is non-negotiable. AI coaching platforms can be designed to learn from and reinforce messaging based strictly on pre-approved compliance guidelines and documentation, mitigating risk.

- Personalization at scale: AI can deliver customized feedback and learning paths tailored to the individual needs of each agent, simultaneously across thousands of users. This addresses the shortcomings of generic training and aligns with the need for personalized development.

- Data-driven insights: AI platforms generate rich data on agent performance, engagement, and skill progression. These analytics allow organizations to track improvement, identify systemic skill gaps, measure the tangible impact of training initiatives, and directly link coaching efforts to key business KPIs and ROI. This facilitates informed decision-making regarding training strategy.

- Efficiency & speed: AI can automate significant portions of training content creation and delivery. This enables organizations to roll out new coaching programs, product updates, or compliance training much faster than traditional methods allow , contributing to quicker agent ramp-up times .

Positioned within a broader framework, AI coaching provides the critical tools, knowledge reinforcement, and practice opportunities necessary for agents to achieve peak performance. It directly supports modern enablement trends such as leveraging data-driven insights, delivering personalized content, and fostering continuous learning and development within the sales team. The specific application of AI sales coaching for insurance enterprise companies offers a targeted approach to overcoming the unique training challenges faced by the sector.

Retorio's Solution: Tailored AI Sales Coaching for Insurance Enterprise Companies

Retorio offers an AI coaching platform specifically engineered to deliver measurable, impactful, and scalable sales coaching solutions for enterprise environments. The platform has demonstrated proven success within the demanding insurance sector, equipping representatives to handle complex interactions effectively, leading to faster productivity and reduced turnover.

The platform's core features directly address the unique needs and pain points of insurance enterprises:

AI Coaching Generator: Rapid, Relevant Content Creation

- Functionality: Users can upload existing insurance documentation—such as product specifications, detailed compliance guides, or successful sales playbooks. The AI analyzes these materials and automatically generates interactive customer simulations and coaching modules based on the provided content . It effectively learns the organization's winning strategies and approved language.

- Insurance Relevance: This capability dramatically cuts down the time required to create relevant, specific training content, especially for complex insurance products or frequent regulatory updates. Modules can often be built in under 20 minutes . It ensures that all training simulations accurately reflect compliance-approved materials and proven sales approaches, addressing the critical need for scalable and compliant content production. This aligns with the broader trend towards leveraging low-code/no-code technologies for faster application development.

- Benefit for Personas: This represents a significant time and resource saving for Sales Enablement, Program Managers, and L&D teams, enabling them to launch new coaching programs and respond to market changes much more rapidly

With our flexible AI coaching generator, you can upload your sales documentation and turn any complex concept into an automated, high-impact AI role play with actionable feedback. Not happy with a detail? Modify the simulation without any programming.

With our flexible AI coaching generator, you can upload your sales documentation and turn any complex concept into an automated, high-impact AI role play with actionable feedback. Not happy with a detail? Modify the simulation without any programming.Virtual Clients/Stakeholders: Realistic, Safe Practice Environments

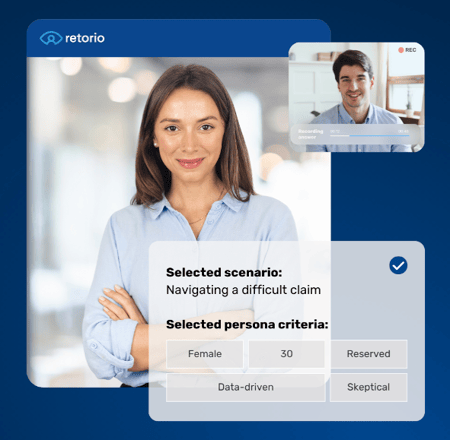

- Functionality: The platform allows the transformation of detailed customer persona descriptions into lifelike AI avatars. These virtual clients possess distinct personalities, specific needs, pain points, and knowledge levels, which can be controlled by uploading relevant data (e.g., new market studies, competitor offerings, product details) . Conversations are dynamic and adapt based on the learner's responses, creating highly realistic interactions.

- Insurance relevance: This feature provides agents with invaluable opportunities to practice engaging with the wide array of customer types encountered in insurance sales – from skeptical prospects and price-sensitive individuals to clients with complex claims histories or business owners requiring specialized commercial lines coverage. Practicing in this psychologically safe space helps build confidence and refine techniques for handling objections, building trust, and demonstrating empathy – crucial skills in insurance where trust is paramount. It effectively replicates the complexity of real-world interactions, offering a far richer experience than static role-playing. Notably, a significant percentage of learners find AI-based role-play more beneficial than traditional methods .

- Benefit for personas: It delivers engaging, practical skill application opportunities that are highly scalable, addressing the need for training that translates directly to improved field performance .

AI Coach: Personalized Feedback at Scale

- Functionality: Retorio's AI Coach provides immediate, objective, and personalized feedback following each simulated interaction. This feedback analyzes both verbal communication (what was said) and crucial non-verbal cues (how it was said), focusing on observable behaviors rather than attempting to infer emotions . Non-verbal communication constitutes a vast majority (estimated 93%) of message impact . The AI acts like a persistent mentor, available 24/7, offering concrete, actionable advice for improvement.

- Insurance Relevance: This constant feedback loop is vital for helping insurance agents hone essential soft skills like active listening, conveying empathy, building rapport, and establishing credibility – all critical for navigating sensitive insurance conversations and building long-term client relationships. The private, non-judgmental nature of the AI coach encourages practice without the anxiety sometimes associated with live coaching or call monitoring. It effectively addresses individual weaknesses identified through performance analytics, ensuring targeted development.

- Benefit for Personas: It provides consistent, scalable coaching reinforcement that efficiently closes knowledge and skill gaps across the entire sales force. This contributes to high user engagement, with typical participation rates ranging from 75-93% and users completing multiple coaching sessions per quarter . Explore more about AI coaching.

AI Analytics: Measuring What Matters

- Functionality: The platform features a robust analytics engine that tracks a wide range of metrics, including learner engagement, satisfaction levels, identified knowledge gaps, behavioral changes over time, and overall performance improvement. Crucially, it allows organizations to connect these training activities directly to tangible business outcomes and KPIs, enabling ROI calculation . It also supports cohort analysis and benchmarking against performance standards.

- Insurance Relevance: This capability directly addresses the critical need within insurance enterprises to measure the effectiveness of training investments and demonstrate a clear return [User Data pain point]. The analytics provide valuable insights into the specific behaviors that correlate with success among top-performing agents, which can then inform and refine future training strategies. It helps quantify agent readiness to handle complex sales conversations and supports the trend towards data-driven decision-making in sales enablement.

- Benefit for Personas: It equips Sales Enablement, Program Managers, and L&D Heads with clear, quantifiable data to report to leadership, justify budget allocation, optimize program design, and demonstrate the business value of their initiatives. An expected ROI of 7-15x in the first year highlights the potential financial impact .

Built for Trust: Compliance and Scalability with Retorio

- Compliance Focus: Recognizing the paramount importance of compliance in insurance, Retorio's AI is explicitly designed to learn only from the compliance-approved documents uploaded by the organization. This ensures that the coaching and recommendations provided align strictly with regulatory requirements and internal policies.

- The platform adheres to regulations like the AI Act, is GDPR compliant, avoids prohibited emotion inference techniques, focuses solely on observable behavior, and utilizes demographically diverse data in its training to mitigate bias . This directly confronts industry concerns regarding AI transparency, fairness, and potential bias.

- Scalability: The platform architecture is built to handle enterprise scale, capable of engaging and coaching thousands of representatives simultaneously . The potential to reach significantly more personnel (up to 42 times more) for the same cost compared to conventional coaching methods directly tackles the core scalability challenge faced by large insurance organizations . Discover more about AI coaching software

-

%20with%20%20AI-Coaching1.png?width=600&height=411&name=Retorio%20-%20Product%20Training%20for%20Insurance%2c%20Pharma%20(or%20any%20other)%20with%20%20AI-Coaching1.png) This image illustrates how knowledge and requirements from different departments (like Marketing, HR/Sales, and Legal) are used to define specific skills and create detailed insurance training instructions within the Retorio's AI coaching platform interface.

This image illustrates how knowledge and requirements from different departments (like Marketing, HR/Sales, and Legal) are used to define specific skills and create detailed insurance training instructions within the Retorio's AI coaching platform interface.

Proof in Performance: The Tangible Impact of AI Sales Coaching

The value proposition of AI sales coaching moves beyond theoretical benefits to deliver concrete, measurable results, providing the quantifiable evidence that enterprise decision-makers require.

A large insurance enterprise NÜRNBERGER Versicherung highlights the transformative potential :

- Enhanced Practice: New hires engaged in 7 times more practice during their onboarding period compared to previous methods.

- Reduced Attrition: First-year agent attrition saw a dramatic 40% reduction.

- Significant Cost Savings: This reduction in turnover translated into approximate annual cost savings of €650,000.

- Improved Performance: Agents achieved a 17% increase in first-year goal attainment.

- Capability Uplift: The new salesforce felt empowered and demonstrated improved ability to handle complex client conversations necessary to acquire new business and navigate diverse sales situations.

The substantial reduction in attrition (40%) offers value far beyond the direct cost savings (€650k) . High turnover not only incurs significant replacement costs but also represents a loss of the initial training investment and can disrupt valuable client relationships. Retaining agents means preserving accumulated expertise, ensuring continuity for clients, and fostering a more stable, experienced, and ultimately more productive salesforce over the long term.

The €650k saving likely captures direct costs like initial training, but the indirect financial benefits stemming from retained talent, stable customer portfolios, improved team morale, and cumulative productivity gains represent substantial additional, compounding value. The increased confidence and preparedness fostered by consistent AI-driven practice are key drivers contributing to this improved retention.

Broader data points reinforce this impact narrative :

- Return on Investment: Organizations implementing Retorio typically see an expected ROI of 7-15 times their investment within the first year.

- Speed of Delivery: Training programs can be delivered more than 10 times faster compared to traditional development cycles.

- High Engagement: An expected user activation rate of 80% significantly surpasses typical e-learning engagement levels (often below 30-50% activation, 10-30% completion). Voluntary participation rates in AI coaching programs consistently range from 75% to over 90%.

- Cross-Industry Validation: Success is not limited to insurance. A pharmaceutical oncology use case saw a 20% increase in sales readiness, a 70% faster agent ramp-up, and 80% user activation. In retail, AI coaching helped elevate moderate performers into the top-performer category, contributing to an estimated 7% increase in revenue.

- Corroborating Evidence: External examples also show AI's impact; one property & casualty firm reported a 10% increase in sales conversions and 23% time savings for team leads by using AI-enhanced performance enablement tools to automate analysis and focus coaching efforts.

"AI coaching can reach up to 42 times more people for the same cost as conventional coaching, fundamentally changing the economics of effective sales training."

This data collectively paints a compelling picture of AI coaching as a driver of efficiency, effectiveness, and financial return. For more insights on onboarding, consider reading sales onboarding training.

|

Metric |

Result (Based on Case Studies/Data) |

|

Practice Increase (Onboarding)

|

7x more practice

|

|

First-Year Attrition Reduction

|

40% reduction

|

|

Annual Cost Saving (Attrition)

|

Approx. €650,000

|

|

First-Year Goal Achievement

|

17% increase

|

|

Ramp-up Speed Improvement

|

Up to 70% faster (Pharma case), >10x faster training delivery overall

|

|

User Activation Rate

|

80% expected (vs. <30-50% for typical e-learning)

|

|

Expected ROI (Year 1)

|

7-15x

|

|

Scalability vs. Conventional

|

Reach up to 42x more people for the same cost

|

Getting Started: Implementing AI Sales Coaching in Your Insurance Organization

Adopting an AI sales coaching platform like Retorio can be more streamlined than anticipated. The ability of the AI Coaching Generator to create tailored simulations from existing documents in under 20 minutes significantly accelerates the content development phase compared to building traditional training programs from the ground up . This speed aligns with the need identified by Sales Enablement and Program Managers for bringing initiatives to market quickly .

Furthermore, implementation can follow a phased approach, perhaps starting with specific teams (like new hires during onboarding) or focusing on particular use cases (such as launching a new complex product) before a wider rollout. This allows organizations to demonstrate value and refine processes incrementally.

Successfully integrating AI coaching requires addressing the core needs of key stakeholders:

- For Heads of Sales Enablement: It provides a scalable solution to deliver high-quality coaching within budget constraints, while offering robust analytics to measure impact and demonstrate ROI .

- For Program Managers: It offers faster implementation timelines for new training initiatives and the inherent scalability needed for enterprise-wide programs .

- For Heads of L&D: It represents a modern, engaging training methodology that effectively develops critical skills, boosts knowledge retention, and provides data on learning effectiveness.

Don’t wait for traditional training methods to catch up to the pace of your salesforce.

Start with a focused pilot today and lead your organization into the future of sales enablement.

The opportunity is here. The urgency is real. The next move is yours.

FAQs for AI sales coaching for insurance enterprise companies

Retorio's AI coaching is built to prepare insurance sales teams for the unique challenges of their field by placing them in realistic virtual simulations that mirror real customer interactions, allowing them to practice crucial skills like building rapport with new clients and mastering objection handling.

By uploading relevant documentation and persona sheets, you can create lifelike AI avatars with specific personalities, needs, and even knowledge levels, providing a psychologically safe space for reps to practice engaging with diverse customer profiles and handling complex conversations just like they would in the real world.

The AI coach analyzes the interaction, providing immediate, personalized feedback and actionable advice aimed at closing knowledge and skill gaps, which helps your team navigate nuances, enhance customer engagement, and ultimately scale strong customer interactions with confidence.

Retorio's AI coaching platform is designed to comply with regulations such as GDPR and the EU AI Act. The platform is ISO-certified and hosted on ISO-certified servers located within the EU, ensuring high data protection standards.

It focuses on analyzing communication patterns and observable behavior for coaching purposes, not on identifying individuals, inferring inner emotional states, or collecting sensitive personal data like discrimination. Legal analysis confirms the system does not perform prohibited emotion inference as defined by of the AI Act.

This design aligns with legal requirements and aims to provide a psychologically safe environment for learners while enabling data control and deletion by users.

Is Retorio's AI coaching considered "high-risk" under the EU AI Act, particularly for training in regulated industries like insurance?

Legal assessments have concluded that Retorio's AI coaching does not fall under the category of high-risk AI systems as defined by the EU AI Act. Its primary function is skill development and performance enhancement through realistic simulations for coaching purposes, not high-stakes evaluation that could impact an individual's educational path, employability, or financial stability.

Furthermore, it is not used for recruitment, selection, evaluation, or monitoring in employment decisions, which are contexts for high-risk classification. The platform is actively used across various industries, including insurance, demonstrating its applicability within regulated sectors while adhering to these legal distinctions.

Can Retorio's AI coaching be tailored to meet specific insurance industry regulations and compliance needs?

Yes, Retorio's AI coaching is designed with flexibility to accommodate specific industry requirements, including those in insurance.

The AI coaching generator allows training administrators to upload company-specific documentation, such as product information, customer data, and importantly, compliance-approved documents.

The system is designed to learn from these documents and provide recommendations that are pre-approved by the organization or compliance teams.

This capability ensures that coaching scenarios and feedback are relevant, align with specific insurance regulations, and help employees practice communicating in a legally compliant manner.

Based on our experience and empirical data, insurance agents demonstrate high acceptance and engagement with AI coaching because it is specifically designed to provide highly relevant, personalized practice in a psychologically safe environment. The platform allows agents to engage in realistic simulated conversations with virtual client avatars, receiving immediate, data-driven feedback and actionable advice on their communication and knowledge application, similar to how pilots use a simulator to prepare for critical situations without real-world risk.

This approach, which focuses on observable communication patterns rather than identifying individuals or inferring inner emotions while providing users control over their data, fosters a safe space for learning and skill development, ensuring compliance with data privacy regulations.

Crucially for regulated sectors like insurance, the AI coaching generator can learn directly from your company's compliance-approved documents and product information to create simulations and feedback tailored to specific regulations and business needs, ensuring practice is relevant and legally sound.

Our data, including results from enterprises in the insurance and telecommunications industries, shows high voluntary participation rates, reaching up to 93%, with users completing numerous coaching sessions and recommending the platform, demonstrating that this impactful and scalable approach drives significant user adoption and effectiveness.

Regarding the cost of implementing AI sales coaching, Retorio offers flexible pricing tailored to your organization's needs.

The pricing model is typically based on the number of users per year or per month. The specific cost per user depends on the license type and the size of your team; you can contact the sales team directly for a detailed breakdown and an offer that fits your requirements. Importantly, creating training content and integrations do not incur extra costs.

Compared to traditional coaching methods, AI coaching can offer significant cost savings, with sources indicating potential reductions of 90% to 98% relative to human coaching.

One large enterprise, for instance, was able to coach 42 times more people for the same cost as conventional coaching.

Additionally, implementing AI coaching with Retorio resulted in an annual cost saving of approximately EUR 650,000 for one of the biggest insurance companies in Germany.

At scale, the server costs for delivering a coaching session can be as low as mere cents.

When it comes to the timeframe for seeing a return on your investment with AI sales coaching, sources indicate that measurable business impact and "quick gains" can often be observed within weeks or months.

Many clients experience a significant ROI within the first year, with expected returns ranging from 7 to 15 times the initial investment. Specific outcomes with demonstrated timeframes include:

- Cost reduction relative to human coaching, achievable within 1-3 months.

- Reduced required human effort relative to conventional coaching, also seen within 1-3 months.

- Faster ramp-up time for new hires, with one source showing a 38% reduction and another showing speed to competency in 5 weeks compared to 12 weeks without AI, leading to significant annual savings.

- Revenue increases ranging from 5% to 15% for B2C Sales, typically realized within 4-12 months, with one example citing a 7% revenue increase in just four months.

- Improvements in sales quota achievement by 15% to 20%, also often within a 4-12 month period.

- Time-to-training-delivery can be drastically reduced from months to just 2-5 hours from concept to market.

Retorio's AI coaching generator can build interactive customer simulations by simply uploading your existing documentation. This allows for the creation of tailored learning experiences where insurance reps can engage with virtual clients who behave like real stakeholders, complete with personalities, needs, and pain points. The AI generator designs entire scenarios, and the platform can assess preferred skills and track their development by uploading your skills and behavioral taxonomies. Training can cover various aspects, including handling objections and questions from virtual clients, with the AI coach analyzing the sales reps' behavior (both verbal and non-verbal) to deliver immediate, personalized recommendations. Retorio can design playbooks with winning strategies for different customer personas and other relevant stakeholders within the insurance context.

Retorio understands the critical importance of compliance in the insurance industry. The AI is specifically designed to learn from compliance-approved documents, ensuring that the recommendations provided are pre-approved by your organization. For the pharmaceutical industry, which shares similarities in regulatory stringency with insurance, Retorio ensures that its AI learns from MLR-approved documents and provides pre-approved recommendations. This capability to incorporate and learn from approved documentation helps guarantee that training content and coaching align with the necessary legal and regulatory requirements within the insurance sector

Yes, Retorio allows you to turn persona sheets into lifelike AI avatars that behave just like your real stakeholders in the insurance industry. You can give these virtual clients a personality, needs, and pain points, and control their knowledge by uploading relevant data such as new studies, product offerings, and competitor information. These customized personas engage your insurance team and replicate any relevant interaction they might encounter in the real world, allowing them to practice and refine their communication and sales techniques in a safe environment

Retorio offers several key benefits for L&D and training managers in the insurance sector. It provides a fast and scalable solution, with fully developed training modules achievable in under 20 minutes. This enables you to launch leadership enablement programs globally in a fraction of the time, ensuring consistent quality, business goal alignment, and impactful delivery. The platform offers tailored learning that adapts to each leader's or representative's needs, ensuring that training translates into real-world impact, not just theory. Retorio is easy to use, relevant, and drives real behavioral change through immersive simulations, leading to improved engagement among learners. Furthermore, Retorio provides AI-powered insights to track leadership progress, knowledge retention, and overall training effectiveness, allowing you to demonstrate a clear return on investment.

Retorio enables you to connect AI coaching to business outcomes, allowing you to track key performance indicators (KPIs) relevant to the insurance industry, such as placement quota and potentially leadership readiness if applicable. The platform allows you to turn training requirements into measurable outcomes by tracking learning progress with tailored scorecards aligned to specific coaching goals. By integrating with CRM and potentially HRM systems, Retorio can help validate whether the behavioral feedback provided is resulting in actual performance improvement, such as sales quota achievement or customer satisfaction metrics. AI analytics drive measurable business impact, with an expected ROI in the first year.

Yes, Retorio's AI is designed to learn from company guidelines and standards, including those specific to the insurance industry, and can provide recommendations that are aligned with your organization. You can upload relevant data, such as product sheets, new studies, competitor information, and compliance documents, to control the AI's knowledge base. The AI coaching generator learns from your documents and adopts your winning playbook, ensuring that the coaching provided is relevant and tailored to your insurance products, processes, and regulatory environment